2025 Investment Outlook

Key Takeaways:

Growth will slow unless labor productivity can increase.

Inflation is making a comeback.

A higher debt burden limits the Federal Reserve’s options.

How Retirees Can Invest with Downside Protection

Retirement presents a unique set of financial challenges for portfolio construction. Many retirees look for ways to generate returns while minimizing risk, especially after spending decades accumulating wealth. At Client First Capital our goal is to protect, preserve and compound. Our portfolio construction is built with two independent portfolios and, depending on our client’s needs, we tailor the mix between these two solutions based on meeting their retirement planning goal and ability to take on risk.

Spread the Warmth: Reasons to Give Back This Summer

As the sun shines brighter and the days grow longer, summer emerges as the perfect season to spread warmth beyond the weather.While many associate this time of year with vacations and relaxation, it also presents a critical period for charitable organizations facing heightened demands. Hospitals, blood banks, and youth support programs require increased support, as do homeless and pet shelters during this time.

Your Perfect Retirement Soundtrack: Top Podcast Picks for Retirees

In a world buzzing with distractions, finding moments of peace and enrichment becomes essential, especially in retirement. Podcasts offer a serene escape from the noise, providing not just entertainment, but also valuable insights and perspectives. Here's a curated list of podcasts that can transform your retirement journey:

Retirement: The Next Best Decade

When discussing getting older too often we hear things like “your best years are behind you”, or “with age comes aches and pains” and many other getting older catch phrases. As we step into the next decade, retirement is undergoing a transformative evolution. No longer confined to a static period of rest after a lifetime of work, the upcoming decade promises to redefine retirement as a dynamic phase filled with opportunities for growth, exploration, and fulfillment.

It’s Financial Literacy Month - Key Components for Financial Success

Financial literacy is the cornerstone of a secure and prosperous future. Understanding the fundamental principles of money management empowers individuals to make informed decisions, navigate economic challenges, and achieve their financial goals. At the heart of financial literacy are six essential components: earning, spending, saving and investing, borrowing, protecting, and financial education and planning.

The Economics of Happiness: Can Money Buy True Joy

Money is often touted as a means to achieve happiness, yet the relationship between wealth and well-being is far more complex than a simple cause-and-effect equation. While financial stability undoubtedly contributes to a sense of security and comfort, the pursuit of material wealth alone does not guarantee lasting happiness.

Choosing the Right Benchmark for Your Retirement Asset Investments

Investment planning for retirement is a complex process that requires careful financial decision-making. A crucial part of this process is assessing whether your retirement assets are on track to meet your future needs. To do this effectively, many individuals and financial advisors use benchmarks to compare their investments to an index. But what exactly is a benchmark, and how can you select one that suits your situation?

2024 Investment Outlook

Our investment framework, as you may recall, uses a four-quadrant approach and is based on the incremental rate of change in both GDP and inflation. Last year, our investment outlook predicted a strong probability of recession, which has not happened (yet). However, a recessionary environment still looks like the most probable outcome for the first quarter.

4th Quarter Investment Planning Outlook

Before diving into the 4th quarter outlook, let's emphasize the importance of building a robust investment portfolio that guards against various risks. Our strategy actively addresses risks such as equity, interest rates, currency fluctuations, liquidity, credit, inflation, foreign investments, time horizons, and economic downturns.

Mastering High Net Worth Financial Planning: The Unique Challenges of Wealth

In today's ever-evolving financial landscape, the importance of financial planning cannot be overstated. It serves as a cornerstone for safeguarding one's financial well-being against life's uncertainties. However, for individuals and families with substantial wealth and complex financial needs, standard financial planning often falls short. This is where High Net Worth Financial Planning steps in to offer tailored solutions.

Maximizing Tax Benefits Through Charitable Planning - A Retirees Take on Charitable Giving

In the world of finance, philanthropy often takes a back seat to discussions of wealth accumulation and investment strategies. However, as my encounter with corporate responsibility at a Fortune 100 Company taught me, charitable planning should be a fundamental part of our financial journey. In this article, we'll explore the concept of charitable planning, its significance, and how it can be leveraged to maximize tax benefits.

Planning for Retirement: Why Many Are Choosing Not to Downsize

For generations, many Americans have considered downsizing as part of their retirement planning goals. By moving to a smaller home, they could leverage the equity in their existing homes to ensure a comfortable retirement. Yet, as retirement age nears, the decision to downsize isn't as straightforward as it might seem. Many are now choosing to stay put. Here's why:

Setting and Achieving Your Retirement Planning Goals

Are you ready to embark on a journey of fulfillment and joy in your retirement years? Just as you've expertly managed your career with clear goals and purpose, retirement planning allows you to craft a remarkable next chapter. Say goodbye to the pressure of performance targets and embrace a new phase of life where your objectives revolve around personal enrichment, experiences, and well-being. Let's explore how you can set meaningful retirement planning goals that will empower you to relish every moment.

Mid-year Investment Outlook: Navigating 2023 and Beyond

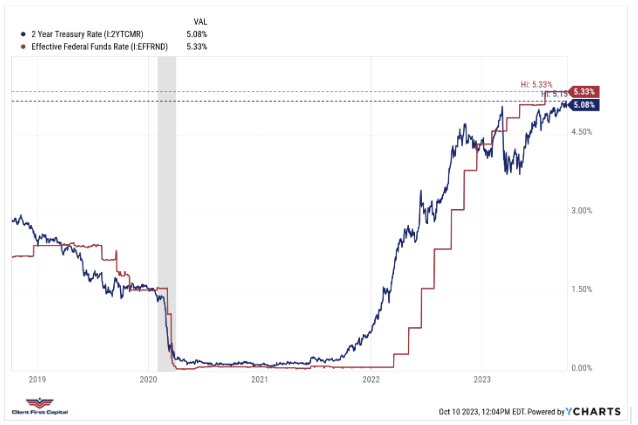

As we step into the latter half of 2023, it's crucial to grasp the evolving dynamics between the economy and the market. In this mid-year investment outlook, we delve into the key occurrences of the past six months and shed light on the potential paths that lie ahead for your investments.

The 2023 Investment Outlook and Investment Planning

Happy New Year! As we embark on our journey into 2023, we would like to share a comprehensive investment outlook that revolves around effective investment planning. The year 2023 brings with it a changing economic landscape, where legislative changes and global events influence the current market conditions.